The interbank rate is a critical financial benchmark that reflects the interest rate at which banks lend to each other for short-term loans, typically on an overnight basis. This rate is a vital indicator in the financial markets, influencing everything from central bank policies to consumer interest rates on loans and mortgages. Understanding the interbank rate trend is crucial for financial institutions, businesses, investors, and policymakers, as fluctuations in these rates can have widespread economic impacts.

Interbank rates are often closely linked to central bank policy rates, such as the Federal Reserve’s Federal Funds Rate in the United States, the European Central Bank’s main refinancing operations rate in the Eurozone, and other central bank rates across the world. These rates provide liquidity to the banking system and help ensure financial stability. In this article, we explore the key factors that influence interbank rates, analyze historical trends, and provide insights into the future outlook of interbank rates.

What is the Interbank Rate?

The interbank rate represents the interest rate charged on short-term loans between banks. Banks often need liquidity to meet reserve requirements, finance short-term operations, or manage cash flow. These loans are typically unsecured and are repaid within a very short period, often overnight.

Key Interbank Rates Across the World:

- Federal Funds Rate (U.S.): This is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. The Federal Reserve controls this rate to influence overall monetary conditions.

- LIBOR (London Interbank Offered Rate): Historically, LIBOR was one of the most widely used global interbank rates. It reflected the rate at which banks in London were willing to lend to one another in various currencies. LIBOR is being phased out and replaced by alternative benchmarks, such as SOFR (Secured Overnight Financing Rate) in the U.S. and SONIA (Sterling Overnight Index Average) in the U.K.

- EURIBOR (Euro Interbank Offered Rate): This is the benchmark rate for the Eurozone, reflecting the average interest rates at which Eurozone banks lend to each other.

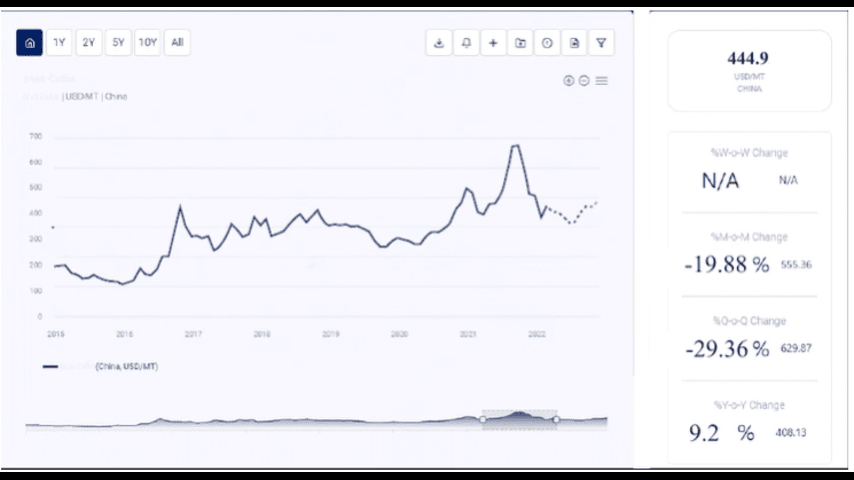

- SHIBOR (Shanghai Interbank Offered Rate): This rate represents the interbank lending rate in China and is used as a benchmark for financial instruments in the Chinese markets.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/interbank-rate-price-trends/pricerequest

Factors Influencing Interbank Rate Trends

Several factors directly affect the interbank rate, including central bank monetary policy, liquidity conditions in the banking system, economic growth prospects, and inflationary pressures.

1. Central Bank Monetary Policy

One of the most significant influences on interbank rates is central bank monetary policy. Central banks use interbank rates to influence overall economic activity by controlling the cost of borrowing in the economy.

- Interest Rate Hikes or Cuts: Central banks adjust their policy rates in response to changing economic conditions. When a central bank raises rates, interbank rates typically increase, as the cost of borrowing for banks rises. Conversely, rate cuts lead to lower interbank rates, encouraging borrowing and liquidity in the system.

- Quantitative Easing (QE) or Tightening: Central banks may implement quantitative easing or tightening measures to manage liquidity. QE increases liquidity by purchasing government securities or other assets, often lowering interbank rates. Tightening, on the other hand, reduces liquidity, pushing rates higher.

2. Inflation and Economic Growth

Inflation and economic growth trends significantly impact interbank rates. Central banks often adjust interest rates to control inflation and stimulate or cool down economic activity.

- High Inflation: When inflation is high, central banks may raise interest rates to curb price increases. This can lead to higher interbank rates, as borrowing becomes more expensive.

- Economic Growth Slowdowns: In periods of economic slowdowns or recessions, central banks may lower interest rates to stimulate borrowing and investment. This typically leads to lower interbank rates as banks borrow at cheaper rates to meet liquidity needs.

3. Banking System Liquidity

The overall liquidity conditions in the banking system also play a crucial role in determining interbank rates.

- Liquidity Shortages: If liquidity is tight in the banking system—meaning there is limited cash or reserves available—banks may raise interbank rates to make it more costly for other banks to borrow. This can occur in times of financial stress, market volatility, or during periods of rapid credit growth.

- Surplus Liquidity: Conversely, when the banking system is flush with liquidity, interbank rates tend to fall. This is often the case during periods of quantitative easing, or when banks have excess reserves that they are willing to lend to other institutions at lower rates.

4. Market Confidence and Risk Perception

Market confidence and the perception of risk within the banking sector can influence interbank rates. During times of economic uncertainty or financial instability, banks may perceive greater risk in lending to one another, which can lead to higher interbank rates.

- Financial Crises: During financial crises, interbank rates can spike sharply due to a lack of trust between banks. For instance, during the 2008 global financial crisis, LIBOR rates soared as banks became hesitant to lend to each other, fearing defaults.

- Stable Economic Conditions: In more stable economic conditions, banks are more likely to lend to one another at lower rates, keeping interbank rates relatively low.

Historical Trends in Interbank Rates

Pre-2008 Financial Crisis

Before the 2008 financial crisis, interbank rates were relatively stable, closely aligned with central bank policy rates. The banking system was flush with liquidity, and economic growth was steady. Central banks used interest rate adjustments to control inflation and manage economic cycles, with interbank rates generally following suit.

2008 Global Financial Crisis

The 2008 global financial crisis led to unprecedented disruptions in the interbank lending market. As banks became unwilling to lend to each other due to fears of insolvency, interbank rates, particularly LIBOR, skyrocketed. Central banks around the world responded with massive liquidity injections and aggressive rate cuts, which eventually brought interbank rates down, but the damage to the global financial system was significant.

- Quantitative Easing (2008-2015): In response to the crisis, central banks, particularly the U.S. Federal Reserve, implemented quantitative easing (QE) programs, which increased liquidity in the banking system and brought interbank rates to historically low levels.

Post-Financial Crisis (2010-2020)

Following the financial crisis, interbank rates remained low for an extended period as central banks maintained accommodative monetary policies to support economic recovery. The Federal Reserve, European Central Bank, and Bank of Japan all implemented near-zero interest rates, keeping interbank rates suppressed.

- Normalization Period (2017-2019): As the global economy gradually recovered, central banks began to unwind QE programs and raise interest rates. Interbank rates started to rise during this period, reflecting tighter monetary policies and healthier economic conditions.

COVID-19 Pandemic (2020-2021)

The COVID-19 pandemic led to a renewed period of low interbank rates as central banks once again slashed interest rates and implemented massive liquidity measures to stabilize economies.

- Global Monetary Easing: Central banks around the world cut interest rates to near-zero levels, leading to historically low interbank rates. The Federal Reserve, for example, reduced the Federal Funds Rate to a range of 0% to 0.25% in 2020, and other central banks followed suit.

Post-Pandemic Recovery and Inflationary Pressures (2022-Present)

As the global economy rebounded from the pandemic, inflationary pressures began to build, prompting central banks to shift toward tighter monetary policies. In 2022, the Federal Reserve and other central banks started raising interest rates to combat rising inflation, leading to increases in interbank rates.

- Rising Interbank Rates: In response to higher inflation, central banks, particularly the Federal Reserve, began a series of interest rate hikes in 2022, driving interbank rates higher. The Federal Funds Rate has been steadily increasing, and interbank rates have followed this upward trend.

Future Outlook for Interbank Rates

Several factors will shape the future trajectory of interbank rates, including:

- Inflation Trends: Inflation will remain a key determinant of central bank policies and, by extension, interbank rates. If inflation continues to run above target, central banks may implement further rate hikes, leading to higher interbank rates.

- Economic Growth and Recession Risks: Economic growth projections and the possibility of recessions will influence central bank policies. If economies slow down significantly, central banks may pause or reverse rate hikes, which could bring interbank rates down.

- Liquidity Conditions: Changes in liquidity in the banking system, driven by central bank balance sheet policies or financial market conditions, will also affect interbank rates. A tightening of liquidity could push rates higher, while surplus liquidity could have the opposite effect.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA