In today’s professional landscape, paycheck stubs have become more essential than ever. Whether you are an employer, employee, freelancer, or independent contractor, having accurate paycheck stubs ensures transparency, compliance, and financial control.

This guide covers everything you need to know about paycheck stubs: their importance, how to create them, what information they must contain, and where you can generate professional stubs using trusted platforms like StubCreator, FreePaycheckCreator.com, and Stubbuilder.com.

What Are Paycheck Stubs?

A paycheck stub (also called a pay stub or pay slip) is a document that outlines an employee’s payment details for a specific pay period. It accompanies a paycheck or digital payment, providing a clear breakdown of:

- Gross earnings before deductions

- Taxes withheld (federal, state, local)

- Deductions for benefits (health insurance, retirement)

- Net pay after deductions

- Year-to-date earnings and deductions

Paycheck stubs are critical for financial transparency and maintaining accurate income records.

Why Paycheck Stubs Are Important

Both employers and employees rely on paycheck stubs for multiple reasons. Here’s why paycheck stubs matter:

For Employees:

- Proof of Income: Needed for loans, rentals, and other financial verifications.

- Financial Management: Helps track earnings, deductions, and savings contributions.

- Tax Filing: Essential for preparing accurate tax returns.

For Employers:

- Compliance: Some states require employers to provide paycheck stubs.

- Dispute Resolution: Paystubs provide written proof of wages paid, preventing disputes.

- Recordkeeping: Simplifies business accounting and legal compliance.

For more details on employer recordkeeping requirements, check the U.S. Department of Labor’s guidelines.

Essential Information to Include on Paycheck Stubs

To be legally valid and professionally useful, paycheck stubs should include:

- Employee’s name and address

- Employer’s name and address

- Pay period start and end dates

- Gross wages earned

- Overtime earnings (if applicable)

- Itemized deductions (taxes, benefits, garnishments)

- Net pay received

- Year-to-date totals for earnings and deductions

Failure to include complete information can lead to compliance issues and employee dissatisfaction.

Who Needs Paycheck Stubs?

Paycheck stubs are useful for various individuals and businesses, such as:

- Employees: To monitor earnings and deductions.

- Self-Employed Individuals: To prove income for financial institutions or landlords.

- Small Business Owners: To maintain professional and legal payroll documentation.

- Freelancers and Contractors: To keep track of payments and taxes owed.

Regardless of the employment type, paycheck stubs play a pivotal role in financial management.

Common Challenges in Managing Paycheck Stubs

While paycheck stubs are essential, managing them can come with challenges:

- Manual Calculations: Increases the chance of human error.

- Time-Consuming Paperwork: Preparing stubs manually is inefficient.

- Compliance Complexity: Different states have varying requirements.

- Security Risks: Improper storage can lead to data breaches.

Using a reliable digital paycheck stub generator helps mitigate these risks effectively.

Best Platforms for Creating Paycheck Stubs

Three of the best online tools for creating paycheck stubs quickly and accurately are:

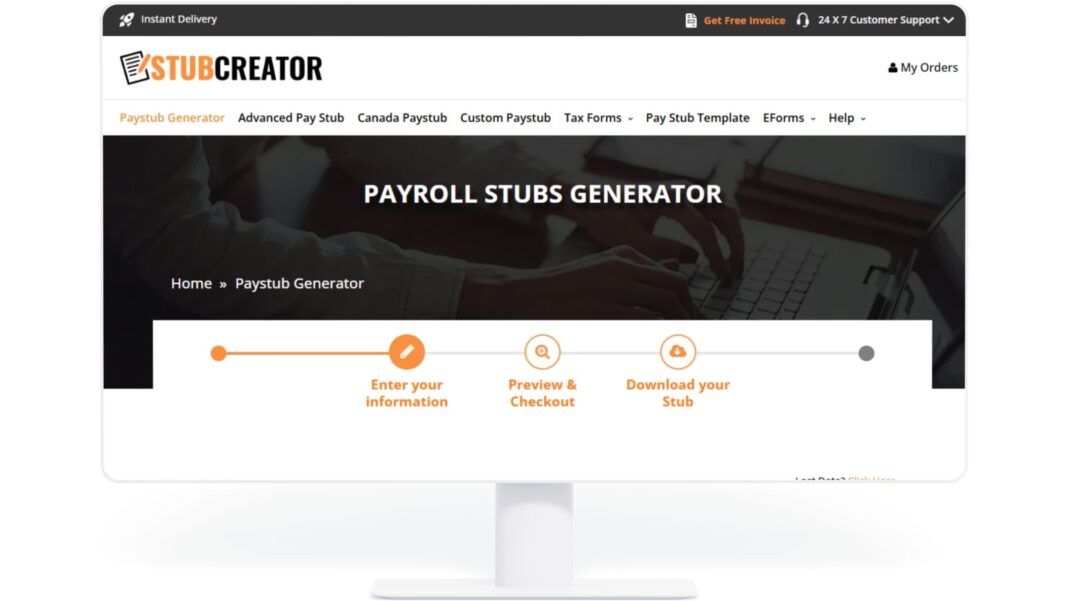

1. StubCreator

StubCreator specializes in providing high-quality, accurate paycheck stubs for employees, contractors, and small businesses.

Key Features:

- Automatic tax and deduction calculations

- Real-time preview

- Downloadable and printable PDF format

- Customizable with company logos and additional earnings/deductions

Why StubCreator Stands Out:

- Easy-to-use interface

- Fast turnaround time

- Professional-looking designs

- Suitable for various employment types

2. FreePaycheckCreator.com

FreePaycheckCreator.com offers a simple, no-registration-required option for creating basic paycheck stubs.

Key Features:

- Completely free for single stub generation

- Simple input form for quick use

- Customizable fields for taxes and deductions

- Instant PDF download

Why Choose FreePaycheckCreator.com:

- Ideal for freelancers and independent contractors

- No hidden fees

- Very user-friendly

3. Stubbuilder.com

Stubbuilder.com is designed for users who need more advanced paycheck stub creation features.

Key Features:

- Multiple stub generation capabilities

- Detailed tax breakdowns

- Year-to-date tracking

- High-quality printable PDFs

Why Choose Stubbuilder.com:

- Excellent for businesses needing detailed, compliant paystubs

- Easy management of multiple employees

- Professional templates that meet state-specific requirements

How to Create a Paycheck Stub in Five Simple Steps

Using an online paycheck stub maker is straightforward. Here’s a step-by-step guide:

- Choose Your Paystub Maker

- Select a trusted platform like StubCreator, FreePaycheckCreator.com, or Stubbuilder.com.

- Input Basic Information

- Enter employer and employee details, including names and addresses.

- Add Income and Deduction Details

- Specify gross wages, taxes, insurance deductions, and any additional earnings.

- Preview and Review

- Check all the information for accuracy before generating the final stub.

- Download and Save

- Download the paycheck stub in PDF format and save it securely for future reference.

Mistakes to Avoid When Creating Paycheck Stubs

Creating paycheck stubs is simple, but common mistakes can cause big problems:

- Incorrect Tax Calculations: Always update tax rates based on the latest federal and state laws.

- Misspelled Names or Addresses: Even minor errors can cause verification issues.

- Incomplete Deductions: Ensure all required deductions are included.

- Incorrect Pay Period Dates: Mistakes in dates can disrupt financial records.

Always double-check before finalizing your stub.

Legal Requirements for Paycheck Stubs

While federal law does not require employers to provide paycheck stubs, many states have their regulations:

- Mandatory States: States like California, New York, and Texas require paycheck stubs.

- Electronic Delivery: Many states allow employers to provide stubs electronically with employee consent.

- Record Retention: Employers must retain payroll records for specific periods (often three years or more).

You can find more information on state requirements through the U.S. Department of Labor.

Digital Paycheck Stubs vs. Traditional Paper Stubs

With the rise of technology, digital paycheck stubs are now widely used. Here’s how they compare:

Digital Stubs:

- Environmentally friendly

- Easily accessible via mobile or desktop

- Instant delivery

- Secure and easy to archive

Paper Stubs:

- Useful for employees without internet access

- Tangible record, but prone to loss or damage

- Storage can be cumbersome over time

Most businesses now prefer digital stubs for their efficiency and sustainability.

How to Store and Manage Paycheck Stubs

Proper management of paycheck stubs ensures financial security and easy access when needed. Best practices include:

- Digital Storage: Save stubs in secure cloud storage or encrypted drives.

- Organized Filing System: Keep stubs organized by year and pay period.

- Backup Copies: Always maintain backup copies in case of data loss.

- Retention Compliance: Adhere to your state’s retention requirements for employee records.

Well-maintained records simplify audits, financial applications, and tax filing.

How Often Should Paycheck Stubs Be Issued?

The frequency of paycheck stubs depends on your payroll schedule:

- Weekly: Every week

- Biweekly: Every two weeks

- Semi-Monthly: Twice a month

- Monthly: Once a month

Employees must receive stubs corresponding to each pay period, ensuring regular updates on their earnings and deductions.

Benefits of Using Online Paycheck Stub Generators

Utilizing platforms like StubCreator, FreePaycheckCreator.com, and Stubbuilder.com provides numerous advantages:

- Speed: Create stubs in minutes.

- Accuracy: Automated calculations minimize errors.

- Customization: Tailor stubs to your business branding.

- Cost-Effective: Many options are free or low-cost.

- Accessibility: Available anytime, anywhere with an internet connection.

Digital tools make paycheck management hassle-free and professional.

Conclusion

Paycheck stubs are indispensable tools for both employers and employees. They provide proof of income, support financial planning, and ensure compliance with various labor laws. Thanks to platforms like StubCreator, FreePaycheckCreator.com, and Stubbuilder.com, creating professional, accurate paycheck stubs has never been easier.

Whether you’re self-employed, managing a small business, or simply looking to organize your financial documents better, using a reliable paycheck stub generator is a smart move toward financial clarity and professional credibility.

Start generating your paycheck stubs today and take control of your financial future with confidence!

External Reference: